Some Known Factual Statements About Medicare Advantage Agent

Table of ContentsMedicare Advantage Agent for BeginnersThe 9-Minute Rule for Medicare Advantage AgentSome Known Questions About Medicare Advantage Agent.The Main Principles Of Medicare Advantage Agent The Of Medicare Advantage AgentMedicare Advantage Agent Things To Know Before You Get This

If the anesthesiologist runs out your health insurance plan's network, you will certainly obtain a shock bill. This is additionally recognized as "balance payment." State and federal legislations protect you from shock medical costs. Discover what expenses are covered by surprise payment laws on our web page, Exactly how consumers are protected from shock clinical bills For even more details concerning obtaining assistance with a shock bill, see our web page, Just how to obtain assist with a surprise medical expense.You can use this duration to join the plan if you didn't earlier. You can likewise utilize it to drop or change your coverage. Plans with higher deductibles, copayments, and coinsurance have reduced costs. But you'll have to pay more out of pocket when you obtain treatment. To find out a business's economic ranking and grievances history, call our Assistance Line or visit our web site.

Call the marketplace to learn more. If you purchase from an unlicensed insurance policy firm, your claim could go unpaid if the business goes broke. Call our Assistance Line or visit our web site to check whether a company or agent has a permit. Know what each plan covers. If you have physicians you want to keep, see to it they're in the strategy's network.

The smart Trick of Medicare Advantage Agent That Nobody is Discussing

Make sure your medicines are on the plan's listing of authorized medicines. A plan will not pay for medications that aren't on its checklist.

There are different warranty associations for different lines of insurance policy. The Texas Life and Medical Insurance Warranty Organization pays claims for medical insurance. It will certainly pay insurance claims approximately a buck limit set by regulation. It doesn't pay cases for HMOs and a few other types of strategies. If an HMO can not pay its insurance claims, the commissioner of insurance policy can designate the HMO's members to an additional HMO in the location.

Your spouse and youngsters also can continue their coverage if you take place Medicare, you and your spouse separation, or you die. They must have been on your prepare for one year or be younger than 1 years of age. Their protection will certainly finish if they get other protection, do not pay the costs, or your company stops providing health insurance policy.

Our Medicare Advantage Agent Ideas

You should tell your company in composing that you desire it. If you continue your insurance coverage under COBRA, you must pay the premiums on your own. Your company doesn't have to pay any of your costs. Your COBRA protection will certainly be the very same as the insurance coverage you had with your company's strategy.

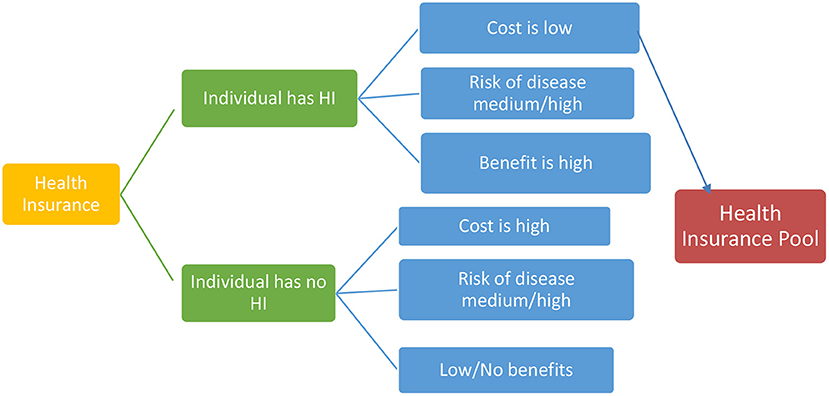

When you have enlisted in a health insurance, be certain you understand your plan and the cost ramifications of different treatments and solutions. Going to an out-of-network physician versus in-network typically costs a consumer much more for the same type of solution (Medicare Advantage Agent). When you register you will certainly be offered a certification or proof of insurance coverage

The smart Trick of Medicare Advantage Agent That Nobody is Discussing

It will also tell you if any kind of solutions have constraints (such as optimum amount that the health insurance plan will pay for resilient clinical tools or physical therapy). And it should tell what solutions are not covered whatsoever (such as go right here acupuncture). Do your research, research study all the alternatives available, and examine your insurance plan prior to making any kind of choices.

Some Known Facts About Medicare Advantage Agent.

When you have a medical procedure or visit, you generally pay your health and wellness care provider (physician, healthcare facility, specialist, etc) a co-pay, co-insurance, and/or a deductible to cover your section of the service provider's costs. You expect your health insurance to pay the rest of the expense if you are seeing an in-network service provider.

Nonetheless, there are some cases when you may need to sue yourself. This can happen when you go to an out-of-network provider, when the service provider does decline your insurance, or when see this site you are traveling. If you need to submit your very own health insurance coverage case, call the number on your insurance card, and the client support rep can educate you exactly how to sue.

Several health insurance have a time restriction for how lengthy you have to sue, normally within 90 days of the service. After you submit the insurance claim, the health insurance has a restricted time (it varies per state) to inform you or your copyright if the wellness strategy has actually approved or rejected the insurance claim.

Medicare Advantage Agent Fundamentals Explained

If it determines that a solution is not medically necessary, the plan may deny or reduce settlements. For some health insurance, this clinical requirement choice is made prior to treatment. For other health insurance plan, the choice is made when the business obtains an expense from the provider. The firm will send you a description of benefits that outlines the solution, the quantity paid, and any type of additional quantity for which you may still be liable.